Customized portfolios for your future

At Maclura, we get to know our client’s financial goals and build a customized portfolio to help them build wealth, the right way.

LATEST INSIGHTS

2nd Quarterly Report

2Q 2024

While the stock market continued its momentum from the first quarter, it has been primarily due to one stock, Nvidia. As outlined in the commentary, while it isn’t unusual that a stock can be up nearly 150% for the first six months of a year, being one ….

3rd Quarterly Report

3Q 2024

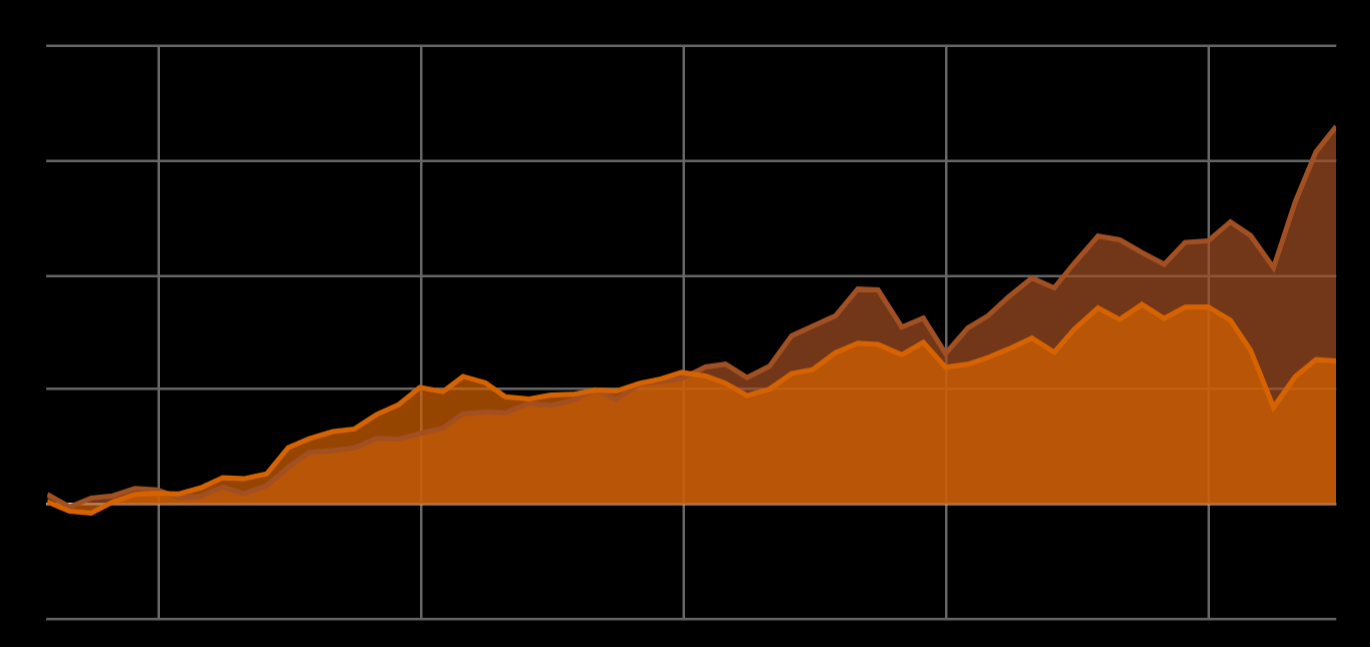

Major US equity benchmarks were higher in the third quarter as the market performance broadened out from the “magnificent 7” large-cap technology stocks that have been driving most of the market mid-year. The Morningstar style and market cap range benchmarks have all returned double-digit returns…

2025 Market Outlook

4Q 2024

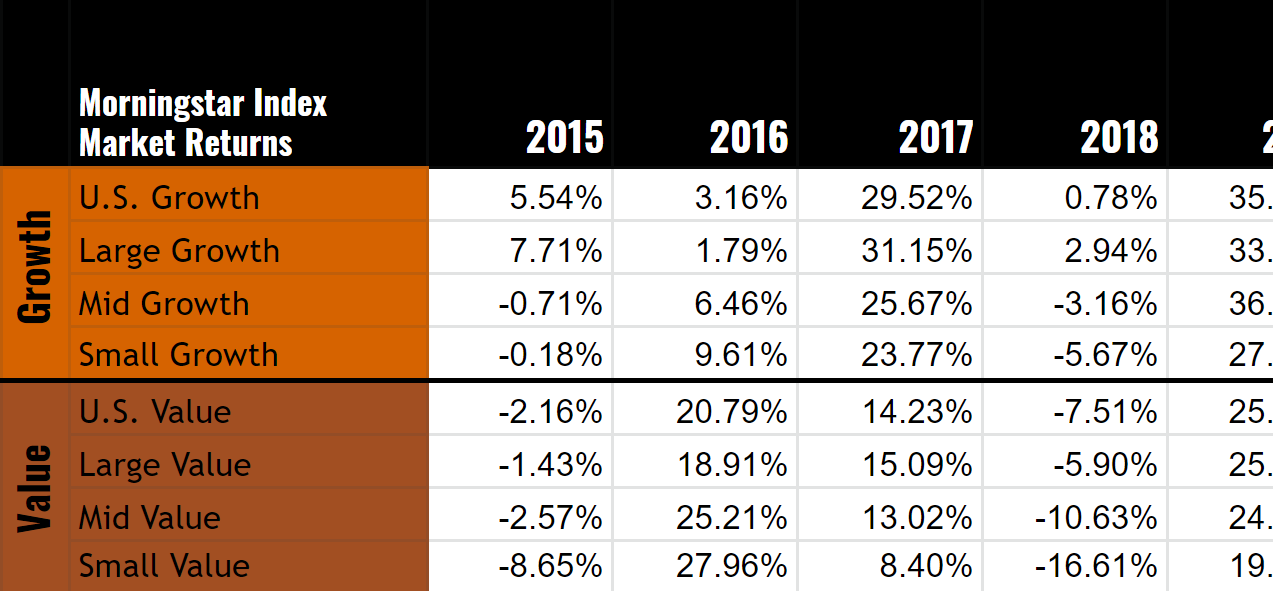

Major US equity benchmarks finished their second consecutive year of double-digit returns, with the exception of the Morningstar US Small Value benchmark (see table below). Although the divergence between growth and value stocks were wide at the end of the year…

Why We are Different

We are investors, not asset gatherers. Most investment advisors outsource their investment management by utilizing mutual funds and exchange-traded funds (ETFs), increasing the overall costs to their clients. At Maclura, we make all investment decisions in-house and construct custom portfolios based upon our nearly 30 years of experience in the industry, eliminating unnecessary hidden fees. With Maclura, you have direct contact with the individual who is making the investment decisions for your portfolio.

Investment Process

At Maclura, our investment process is based on identifying companies that are beneficiaries of long-term trends that provide a tailwind to their business, regardless of the overall health of the economy. We seek companies that are disrupting legacy markets by developing unique solutions to problems, those known and unknown to end markets. We then analyze these companies based on the Maclura Foundational Factors to build a premium list of potential investments for our clients.

Investment Process

Portfolio construction

After an extensive research process, we use a disciplined approach of placing our investable universe of stocks into four growth categories: emerging, thriving, durable, and cyclical growth. These growth categories reflect different risk and growth profiles of where each company is in their life cycle. A portfolio is then constructed with a varying mix of each category to accommodate different risk profiles and investment objectives for each client.

© MACLURA INVESTMENTS, LLC

LEGAL DISCLOSURES